Traditional Cashback vs Crypto Rewards: Which Actually Grows Your Wealth in 2025?

- Sep 27, 2025

- 5 min read

Your daily coffee, grocery shop, and petrol fills are either building your wealth or just disappearing into thin air. The question isn't whether you should earn rewards on your spending: it's whether you should stick with traditional cashback or jump into the crypto rewards game that's reshaping how Australians think about their money.

Both approaches offer completely different wealth-building strategies, with crypto rewards providing explosive growth potential through asset appreciation while traditional cashback delivers rock-solid, predictable returns. The winner depends on your risk appetite, investment timeline, and whether you believe digital assets are the future of finance.

The Traditional Cashback Game: Safe But Limited

Traditional cashback credit cards are the reliable mate you can always count on. When you earn that 1-2% back on your groceries at Woolies or your monthly phone bill, that money keeps its value and sits there ready to use whenever you need it.

The Strength of Predictability

There's something beautifully simple about knowing exactly what you're getting. Earn 2% cashback on $1,000 of spending, and you've got $20 in your pocket. No market volatility, no conversion fees, no wondering if your rewards will be worth half as much tomorrow morning.

Most Aussie banks offer these cards with straightforward structures: Commonwealth Bank's Ultimate Awards card gives you 3 points per dollar at major retailers, which translates to about 1.5% in real value. ANZ's Cashback cards offer direct cash returns up to 1% on everything. Simple, clean, effective.

Where Traditional Falls Short

But here's the rub: that $20 cashback is still $20 in five years' time (actually less due to inflation). While you're getting guaranteed value preservation, you're missing out on any growth potential. That money doesn't work for you: it just sits there, slowly losing purchasing power as inflation chips away at its real value.

Traditional cashback is like putting your rewards in a term deposit at 0% interest. Safe? Absolutely. Wealth-building? Not really.

Crypto Rewards: Your Spending Becomes Your Investment Portfolio

Crypto rewards cards flip the script entirely. Instead of earning dead cash, every purchase becomes an automatic investment in digital assets that could potentially multiply in value over time.

The Growth Potential Game-Changer

When you earn 2% back in Bitcoin through a crypto rewards card, you're not just getting 2%: you're getting exposure to an asset that's historically shown massive growth potential. That $100 in Bitcoin rewards from January 2023 would be worth significantly more today, depending on when you earned it.

Some platforms offer even more aggressive reward rates. Premium crypto cards can deliver up to 5-8% back in crypto, though these often require staking significant amounts of the platform's native token. Even the entry-level rates of 1-2% become more attractive when the underlying asset appreciates.

The Volatility Reality Check

But let's be brutally honest here: crypto rewards can also go backwards. That $100 in Bitcoin rewards could become $50 during a market downturn. Unlike traditional cashback where you know exactly what you're getting, crypto rewards introduce genuine investment risk into your everyday spending.

The volatility cuts both ways though. While your rewards might lose value in the short term, they also have unlimited upside potential. Traditional cashback has a ceiling: crypto rewards don't.

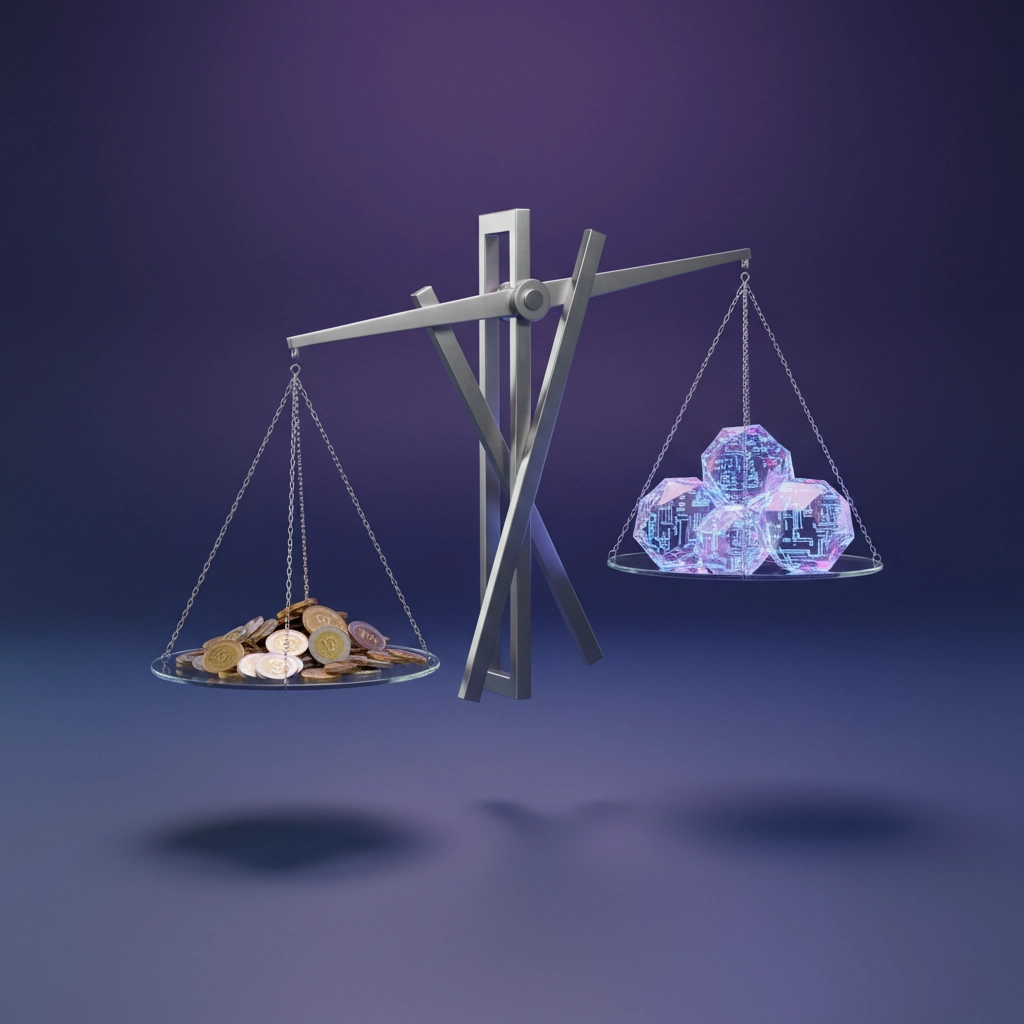

Real-World Wealth Building: The Numbers Don't Lie

Let's run some realistic scenarios based on typical Australian spending patterns. Say you put $30,000 annually through your rewards card: a reasonable amount covering groceries, petrol, bills, and everyday expenses.

Traditional Cashback Scenario

Annual rewards: $450 (1.5% average rate)

Five-year total: $2,250

Real purchasing power after inflation: ~$2,050

Crypto Rewards Scenario (Conservative)

Annual rewards: $600 (2% rate)

If crypto appreciates 15% annually: ~$4,500 after five years

If crypto stays flat: $3,000 after five years

If crypto drops 20% and stays down: $2,400 after five years

The crypto scenario shows both the opportunity and the risk. In the best case, you're looking at double the wealth creation. In the worst case, you're still ahead of traditional cashback.

The Hybrid Strategy: Best of Both Worlds

Smart Aussies aren't choosing sides: they're using both strategies tactically. Here's how the hybrid approach works:

Use a traditional cashback card for essential spending where you need that money to be reliable: rent, utilities, groceries, medical expenses. This ensures your baseline rewards maintain their value regardless of market conditions.

Deploy crypto rewards cards for discretionary spending: dining out, entertainment, travel, shopping. These are expenses where you can afford to have the rewards fluctuate in value without affecting your financial stability.

This approach lets you capture the upside potential of crypto rewards while maintaining a stable foundation for your essential spending rewards.

Tax Implications: The Hidden Factor

Here's something many Aussies overlook: the tax treatment differs significantly between the two approaches. Traditional cashback is generally considered a rebate on your purchase and isn't taxable income. Crypto rewards, however, might be considered assessable income at the point you receive them, depending on the ATO's interpretation.

You'll also need to track the value of crypto rewards for capital gains tax purposes when you eventually sell or use them. This adds complexity but isn't necessarily a dealbreaker: just something to factor into your decision.

Making Your Choice in 2025

Go with traditional cashback if:

You're within 5-10 years of retirement and need portfolio stability

You live paycheck-to-paycheck and can't afford rewards volatility

You prefer simple financial products without complex tax implications

You're highly risk-averse and prioritise capital preservation

You need immediate access to rewards for budgeting purposes

Choose crypto rewards if:

You have a long-term investment horizon (3+ years minimum)

You're already bullish on cryptocurrency and want automatic accumulation

You can mentally handle seeing your rewards balance fluctuate

You're comfortable with the additional tax complexity

You want to maximise potential returns and accept the associated risks

Consider the hybrid approach if:

You want some exposure to crypto upside but need stability for essentials

You have both discretionary and non-discretionary spending to optimise

You're interested in crypto but don't want to go all-in with your rewards strategy

The Verdict: Context Is Everything

There's no universal "better" choice between traditional cashback and crypto rewards: it depends entirely on your financial situation, risk tolerance, and investment beliefs. Traditional cashback offers guaranteed value preservation with limited growth, while crypto rewards provide unlimited upside potential with significant downside risk.

The most important thing is that you're earning rewards on your spending rather than letting that opportunity slip away entirely. Whether you choose the predictable path of traditional cashback or the potentially explosive growth of crypto rewards, you're ahead of the millions of Australians earning nothing at all on their everyday purchases.

For most Aussies in 2025, the hybrid approach offers the best balance: combining the stability of traditional cashback for essentials with the growth potential of crypto rewards for discretionary spending. This strategy lets you sleep well at night while still positioning yourself for potential wealth creation through the digital asset revolution.

The key is starting somewhere, staying consistent with your chosen approach, and adjusting your strategy as your financial situation and market understanding evolves. Your future self will thank you for turning everyday spending into wealth-building opportunities, regardless of which path you choose.